Revised RTF-1 & RTF-1EE Forms - Effective 3/2022

Revised RTF-1 & RTF-1EE Forms - Effective 3/2022

As of March 2022, the State of New Jersey updated the RTF-1 & RTF-1EE Forms, otherwise know as the Affidavit of Consideration for Use by Seller and the Affidavit of Consideration for Use by Buyer. As stated in both new forms, transfers of real property that are intercompany transfers between combined group members filing a New Jersey combined return as part of the unitary business of the combined group are exempt from the grantor and grantee fees.

RTF-1 Revisions

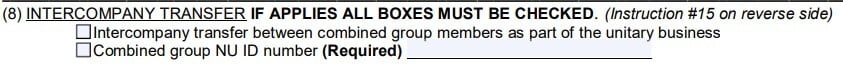

The Affidavit of Consideration for Use by Seller includes a new Section 8, and paragraph 15 in the instruction page.

New Section 8:

New Paragraph 15 of the RTF-1 Instructions Page Reads:

15. Intercompany Transfer Between Combined Group Members that File a New Jersey Combined Return

Transfers of real property that are intercompany transfers between combined group members filing a New Jersey combined return as part of the unitary business of the combined group are exempt from the grantor and grantee fees. Transfers must indicate the combined group NU identification number assigned by the Division of Taxation. If the NU number has not been assigned for any reason then the RTF must be paid and a refund may be applied for.

RTF-1EE Revisions

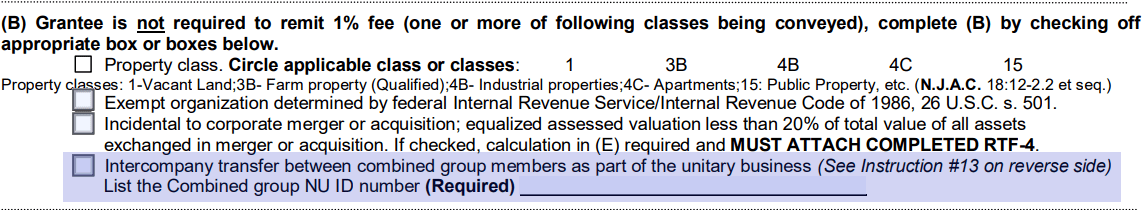

The Affidavit of Consideration for Use by Buyer includes a new check box under Section 2(B) and paragraph 13 in the instructions page.

New Section 2(B) Check Box (Highlighted):

Paragraph 13 of the RTF-1EE Instructions Page Reads:

13. Intercompany Transfer Between Combined Group Members That File a New Jersey Combined Return

Transfers of Real Property that are intercompany transfers between combined group members filing a New Jersey combined return as part of the unitary business of the combined group are exempt from the grantor and grantee fees. Transfers must indicate the combined group NU identification number assigned by the Division of Taxation. If the NU number has not been assigned for any reason then the RTF must be paid and a refund may be applied for within 90 days for the 1% fee. Claims received beyond the 90 days will not be approved.